We are concluding 2025. Throughout this tense and difficult year, there have been many important events, accompanied also by analyses, reports, debates and publications that, from academia, try to contribute to a better understanding and to propose alternatives. The latter seek to contribute to overcoming the difficult situation in which the Cuban economy and society find themselves, even though they are often not taken into consideration.

In light of this time and the successive analyses that have been presented, it seems useful to ask ourselves, very briefly, what remains and what has arrived in the Cuban economy after these last twelve months.

What remains:

- A recession that shows no signs of abating, with a GDP that will be more than 12 points below that obtained in 2019, six years later.

- Notable macroeconomic imbalances with some quantitative, but not qualitative, relief.

- Insufficient food production; some items grew, others decreased and the food industry is far below (between 30 and 45%) the plan set for this year that is ending. The strong dependence on imports in this sector remains.

- Deep sectoral crises (energy, water, sanitation, infrastructure, health, etc.)

- Greater participation in retail sales by the emerging private sector (with a greater relative supply and also higher prices).

- Low efficiency and profitability of the state sector, despite the 2,741 state-owned enterprises…. The 308 enterprises operating at a loss last year were reduced to 264 in September of this year. More than 31% maintain moderate to low profitability, often explained more by price increases than by increases in physical sales. From January to May of this year, only 29 enterprises, 1.1% of the total, obtained considerable profits, exceeding 500 million pesos (CUP). Average employment in that period decreased by 6.3% and labor productivity showed a slight increase of 1.5%.

- Stagnation of exports (estimated at a 7% decrease compared to the previous year), which is explained by the recession in the production of goods and services, due to internal factors of lack of efficiency, productivity and energy, combined with strong external constraints (primarily, the increased U.S. sanctions and the state of the international economy).

- Monetary market with diverse exchange rates and without the capacity for regulation by the central bank, which leaves room for the impact of parallel exchange rates with a notable speculative component, a situation that disrupts the entire operation of the economy in its various sectors.

- Banking sector with serious operational problems, which remains a significant obstacle to the process of bancarization.

- Fiscal policy with a regressive impact and a significant level of tax evasion, which, among other factors, does not effectively utilize a fundamental document such as the mandatory issuance of invoices. The future and possible introduction of VAT should take these considerations into account; I addressed this specific point extensively in a recently published article.

- Investment policy that does not adequately respond to the country’s priorities, despite its recent modification in favor of the energy sector, but which is still insufficient and lacks the necessary increases for the agricultural sector.

- Demographic crisis that weighs on the reduction and aging of the population, low birth rate and significant emigration. The latter primarily involves young people, many of whom are highly skilled. All of this poses a serious limitation to the economy and development.

- Notable erosion of confidence in institutions.

- Social crisis, with increased poverty, which current social policies are failing to compensate for.

What’s new:

- A change in the investment structure responding to the energy emergency: investment in the sector has increased to 10% due not only to maintenance efforts on thermoelectric plants that are in very poor condition, but also to the widespread installation of solar panels, which is important, although for the moment they only provide about 7% of the available energy (the energy sector has 43% of its power generation capacity affected).

- For this reason, investment in tourism has decreased from more than 30% to nearly 20%, but investment in agriculture remains stuck at around 3%.

- There is a relative reduction in the budget deficit. The latest available figure placed it at 6% of GDP, still high, but notably lower compared to the levels it recently reached, of around 18%, which is due not only to better fiscal management, but also to budget items that went unspent: about 14 billion CUP.

- This deficit reduction is important in relation to the relative recovery of macroeconomic balances and inflation control, but strictly speaking, reducing the budget deficit is not an end in itself. One of the great challenges of the economy is to reduce the deficit while simultaneously neutralizing or reducing its potential recessionary effect, which is only possible if it is accompanied by supply-side measures. That is: effective incentives for production and exports, articulated in the correct sequence, and this means profound transformations in the structure of the productive sector and in the economic model.

- There is a decrease in the level of year-on-year inflation, but its qualitative effect on the population and the economy continues to be very strong and risky. The anchoring of wages and pensions to contain demand-side pressure on prices shifts the cost of adjustment onto broad sectors of the population, with strong social effects such as increased poverty.

- Partial renegotiation of foreign debt, which has basically allowed for the rescheduling of payments and possible swap operations with Spain, but this is no guarantee of the opening of new credits and financing lines.

- New and positive measures for foreign investment, recently announced at the Havana Trade Fair. However, again, the potential positive effect of this on investment would likely be negated without other simultaneous and sequential changes in the economic model.

- Expansion of the so-called partial dollarization of the economy, still insufficiently explained in its scope, limits and objectives. Dollarization is always a high-risk path, especially if it is not clearly integrated into a process of systemic and profound transformations that allow for an exit strategy within a reasonable timeframe.

- Greater presence of Cuba in important emerging spaces such as the BRICS, but based on an economy in crisis and with low efficiency, which limits the opportunities that open up there. It cannot be forgotten that economic relations based fundamentally on political agreements are a thing of the past.

- Very strong impact of Hurricane Melissa on the eastern provinces, which places additional pressure on the economy and society.

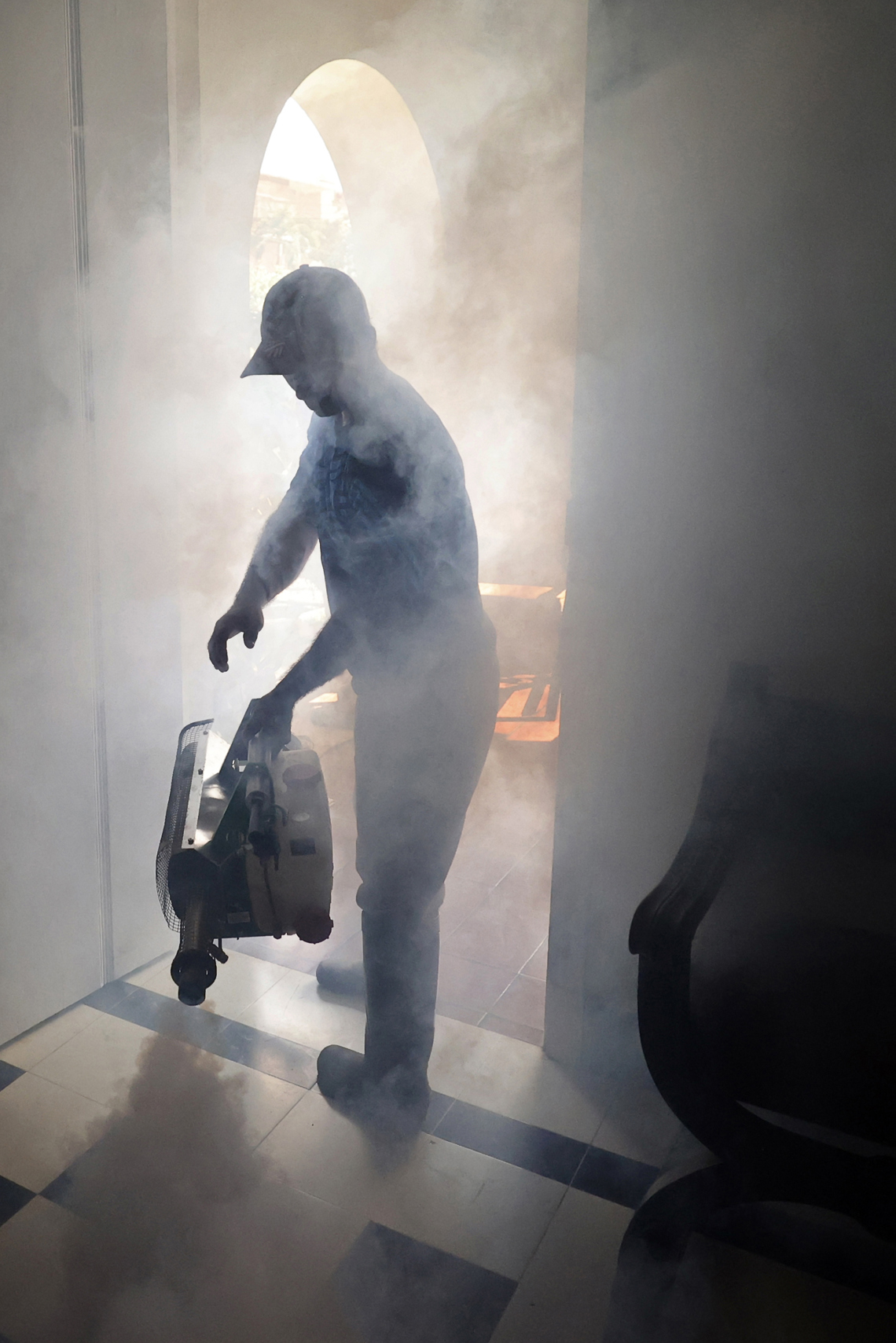

- Strong impact of several vector-borne epidemics that are out of control, with great social and economic damage and an overwhelmed healthcare system.

- Increased tension in the global geopolitical crisis, whose conflict has dangerously approached the country’s borders, with the strong U.S. naval deployment in the Caribbean and unjustified operations of maximum aggression, which seem to be part of that country’s new Homeland Security Strategy. According to the text of this document, the Western Hemisphere becomes a central focus of the U.S. strategy, reinforcing the claim of an uncontested hegemony in this area. The risks for Cuba are obvious and must be taken seriously.

- Presentation and call for debate on a Government Program to correct distortions and revitalize the economy. This is undoubtedly an important step, as it aims to address the key issues that need to be resolved in the economy to put it on the path to overcoming the structural crisis that affects it. Since it is subject to debate, it is presumably still a draft.

Now then, the question is whether, as we know it, this Program is in a position to achieve its objective. Our answer is no, because, although it has positive elements, it is incomplete, disjointed, confusing and deficient in fundamental aspects.

The Cuban economy today remains essentially based (despite the significant changes it has undergone) on a model of bureaucratic planning and low efficiency, blocked, with strong external restrictions, lack of financing and without dynamic sectors that can overcome the resistance to takeoff.

Tourism, which has concentrated the vast majority of investment in recent years, close to and even more than 30%, with a reduction to around 20% this 2025, due to the resources demanded by the very strong energy crisis, remains in contraction and with a hotel occupancy rate during 2025 of less than 20%. This is a sector that, in addition to its problems in service quality, is very sensitive to external sanctions.

The sugar sector is a mere shadow of what it once was. Harvests do not reach 200,000 tons. Nickel and cobalt are affected by international prices and the closure of markets. Tobacco has grown, responding to some innovative policies and new incentives in the sector. Biopharmaceutical products continue to be developed, but with difficulties in accessing international markets, and medical services abroad continue, although under strong pressure from this U.S. administration.

Summary and conclusion

The contraction of the economy explains the impossibility of increasing the production of goods and services, which depresses consumption and exports. Macroeconomic imbalances and the uncontrolled exchange market limit the effectiveness of economic policies.

The lack of a flexible, properly regulated, operational and sustainable foreign exchange market prevents the coordinated functioning of the productive system across all its sectors and economic actors; this is not a minor issue, it is essential.

The most complicated problem is the loss of the economy’s growth capacity, without dynamic sectors, combined with the presence of a bureaucratic and inefficient planning model. In addition, there is the persistence of clear urgent needs such as food, energy and healthcare deficits, the inability to pay debts, etc., which demand immediate and priority responses, but which at the same time do not prevent a solution connected to deep structural reforms. The parts must be integrated with the whole, even when it is necessary to establish priorities. Sacrificing the comprehensiveness of the process, in terms of timing and the appropriate sequence, would be suicidal.

The only possible solution is a comprehensive and profound reform, and this document now under discussion does not contain it. First and foremost, a reform that addresses the recovery of macroeconomic balances, attends to urgent needs and connects all of this with deeper structural changes.

The main ones are: the reform of state-owned enterprises, not so that they cease to be public, but so that they cease to be inefficient, accompanied by better coordination with and a boost for the private and cooperative sectors, and the profound transformation of the agricultural production subsystem. None of these are clearly defined in the Government Program.

A program for the comprehensive transformation of the economy must precisely identify the economic policy objectives and the tools to achieve them. It is not a matter of listing aspirations without adequately defining how to achieve them, establishing stages, areas of action, correct sequences, well-founded indicators (not general ones), alternative sources of financing and, above all, a strategic vision of the type of economy and society that is aspired to. The architecture and strategic direction of the transformation are essential.

There is considerable similarity between this new document and the Guidelines that were approved 14 years ago, when it is necessary and imperative to go much further.

Expressions such as “update,” “improve” and “promote” are frequently overused. We must ask ourselves: update what, improve what, promote what and when? The point is to change in a comprehensive and profound way. This is where the idea of ”changing everything that needs to be changed, and with great urgency” comes into play.

________________________________________

Author’s note: All statistics are based on reports from the National Office of Statistics and Information (ONEI) and reports from the Center for Cuban Economic Studies at the University of Havana.

*This text was originally published on the author’s Facebook profile. It is reproduced with his express permission.

Other Communist countries, like China and Vietnam, are very successful. There is no reason why Cuban cannot be also. What is their secret?