Read the first part of this article.

On August 14, the National Office of Statistics and Information (ONEI) published the data on Cuban foreign trade corresponding to 2022. It is therefore appropriate to update a previous analysis on the most relevant trends and the “geopolitical” distribution of the Cuba’s trade in goods with the world. To do this, we will consider its behavior during the 2017-2022 six-year period, thus moving the period subject to statistical processing one year forward.

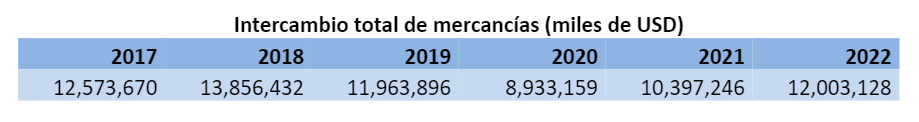

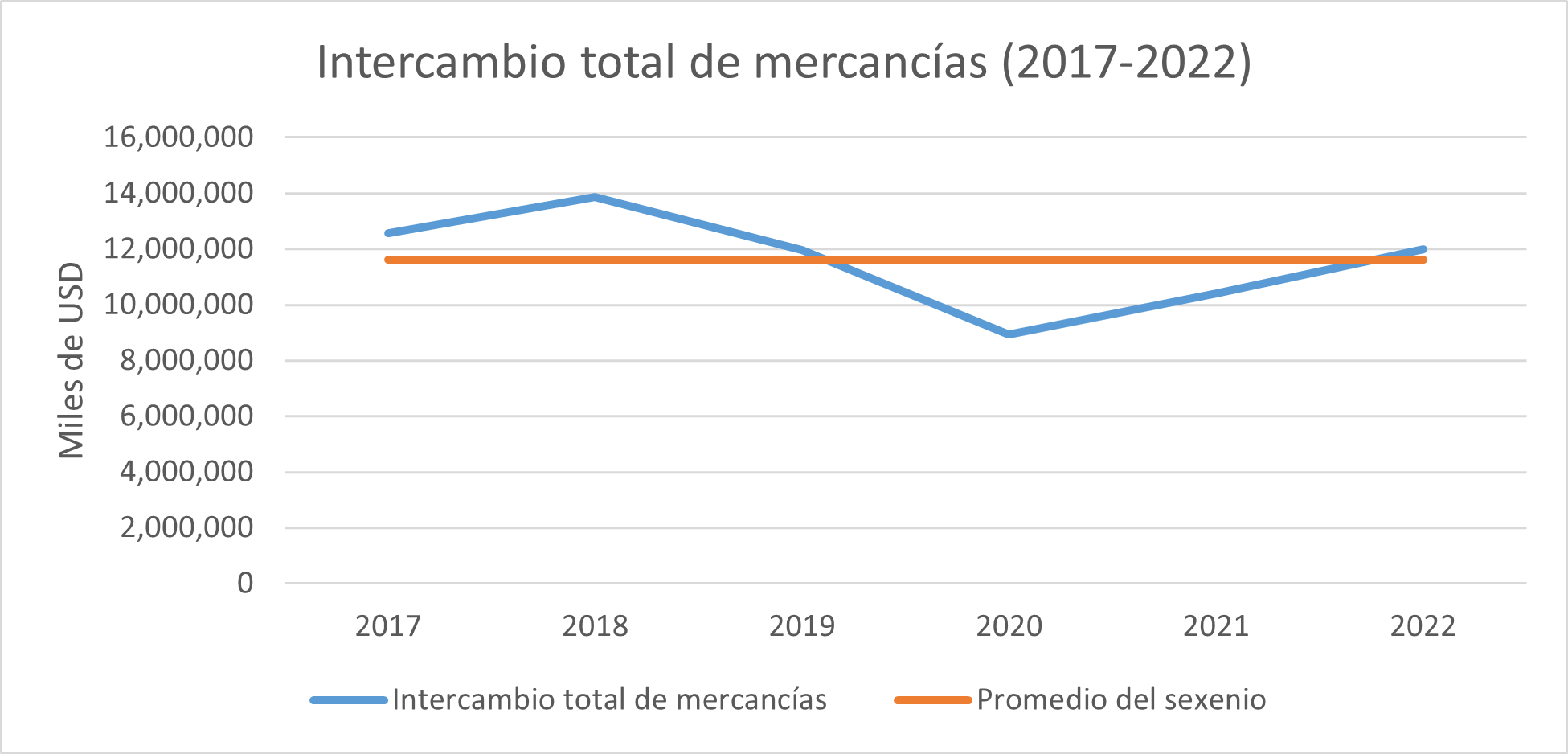

Total trade in goods (thousands of USD)

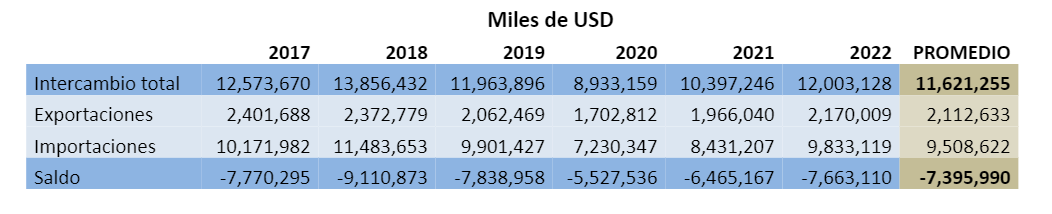

In 2022, the U.S. dollar value of total trade in goods recorded a significant growth of 15%. However, this was not enough to recover the amount reached in 2018. And, if we place this result in a longer time horizon, it should be noted that it only represented 60% of the total exchange carried out in 2013 (19.99 billion dollars), the year with the highest historical record in the ONEI report.

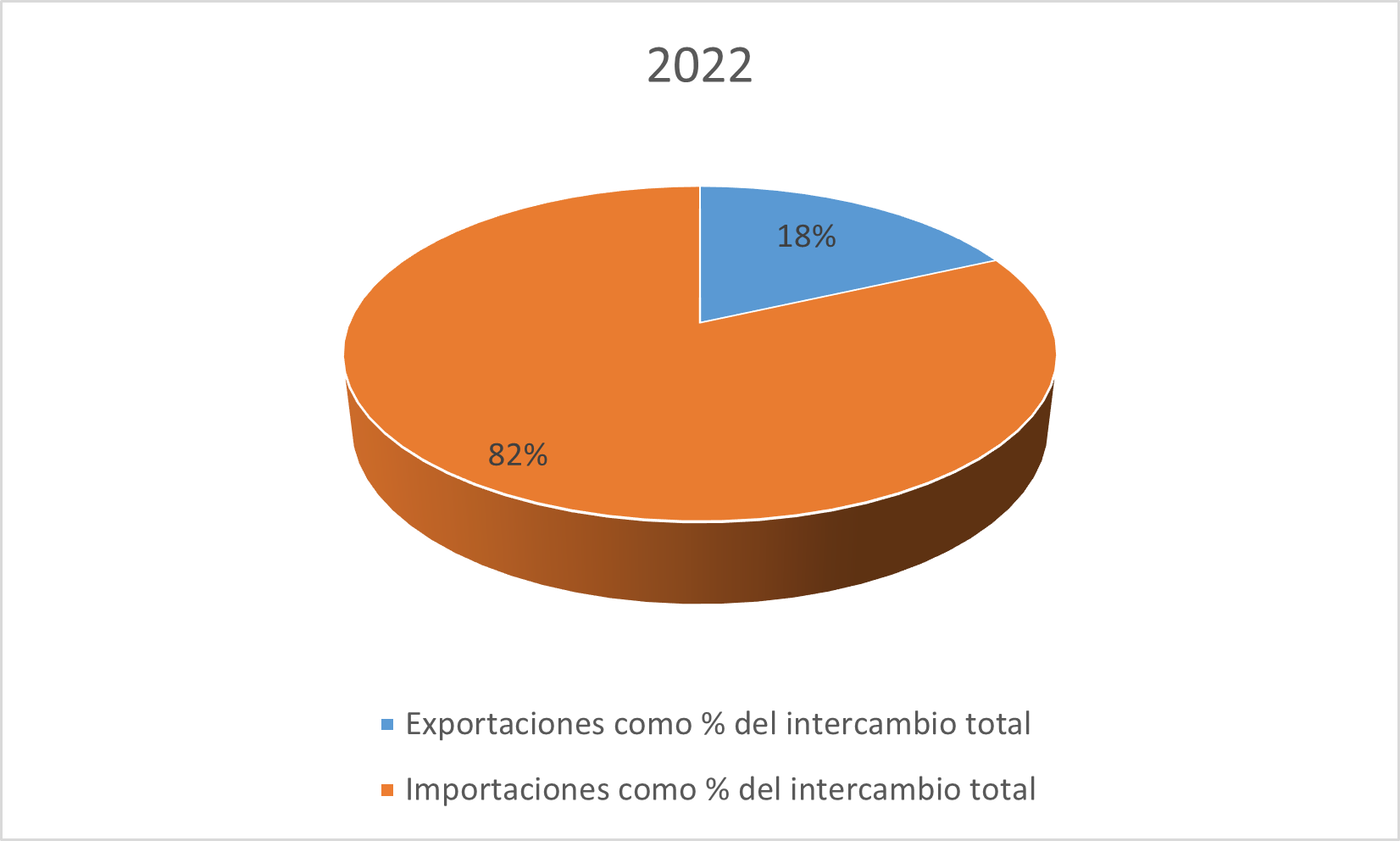

On the other hand, last year there was no change in terms of the accentuated and historical imbalance between exports and imports. The former represented only 18% of the total exchange (coinciding with the annual average of the six-year period) and increased the deficit balance by more than 1 billion dollars with respect to the previous year.

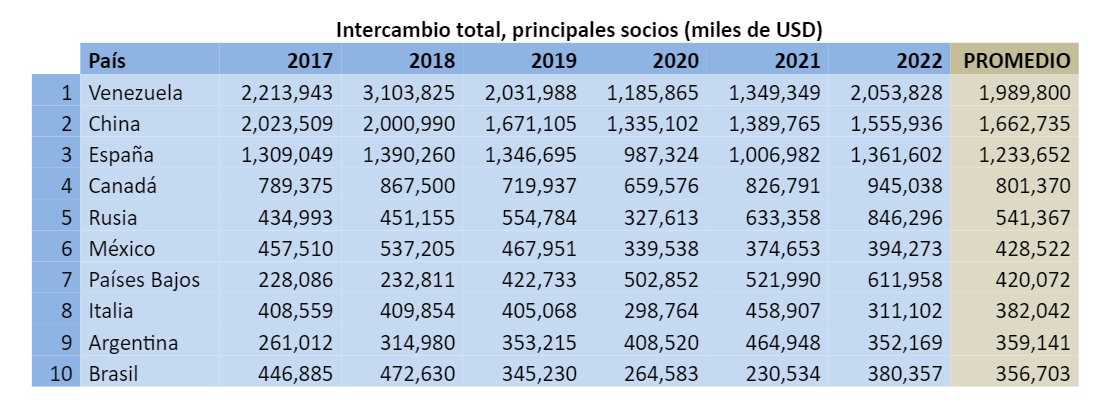

Considering the total exchange of goods (sum of exports and imports), Cuba’s ten main partners, according to the annual average of the six-year period, were the following:

In 2022, the partners with the highest growth were Brazil (65%), Venezuela (52%), Spain (35%) and Russia (34%), while Italy (32%) and Argentina (24%) decreased.

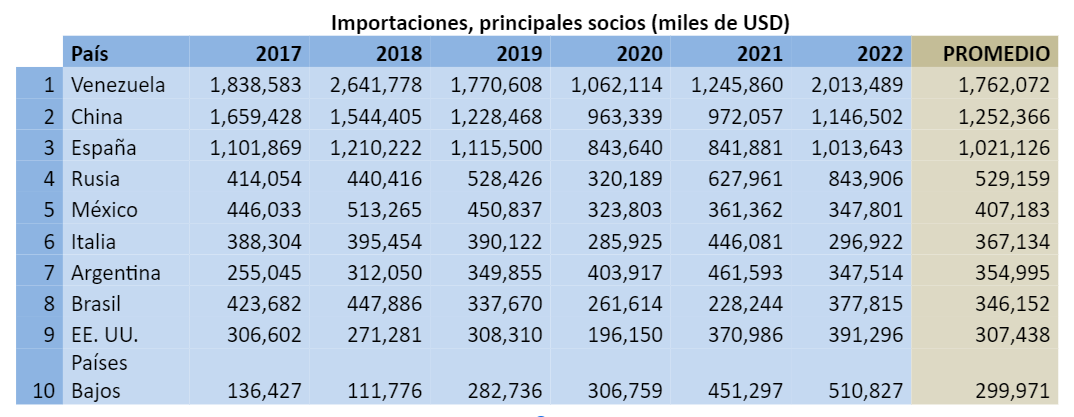

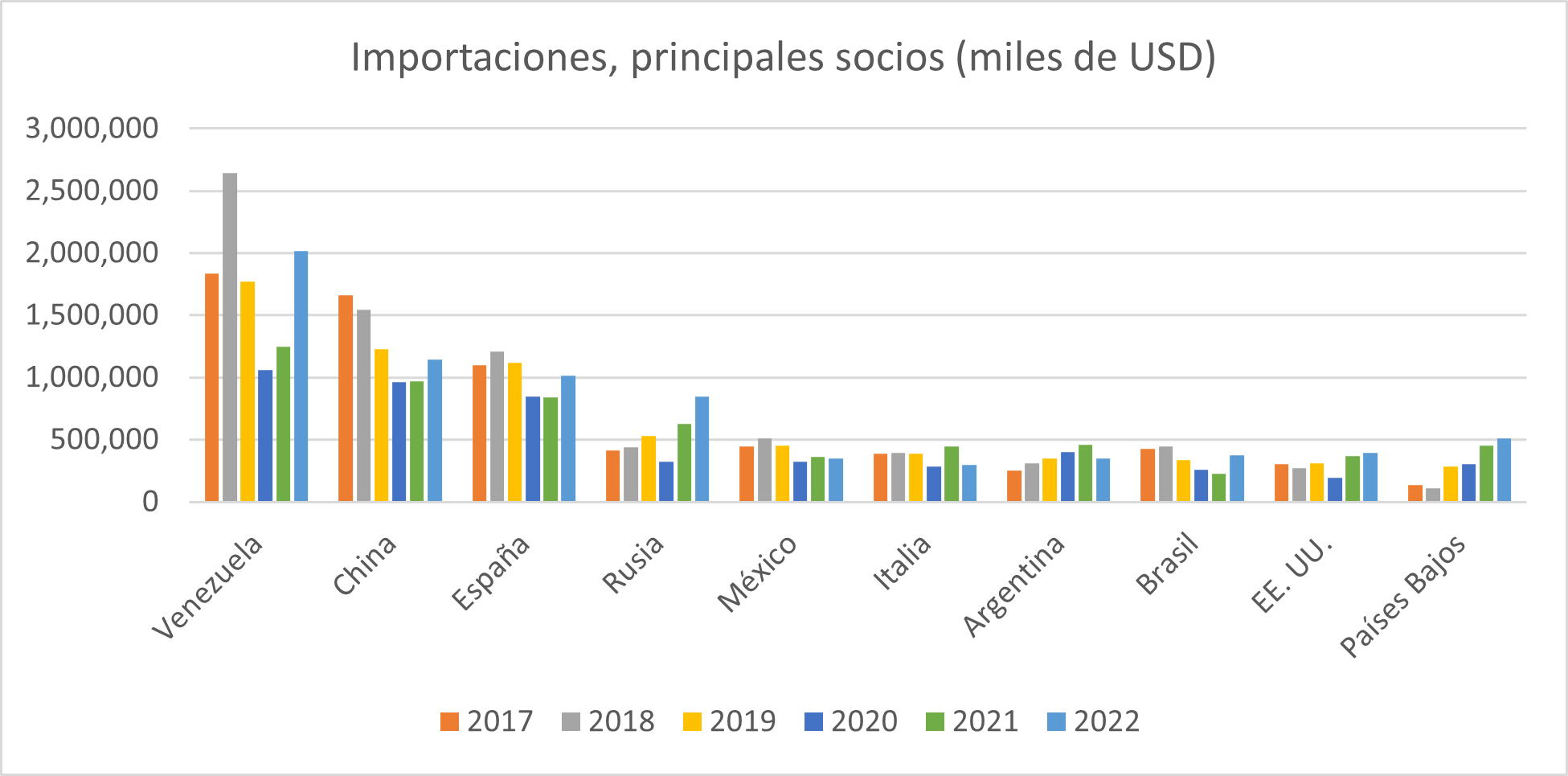

On the import side, Cuba’s ten main trading partners, according to the six-year annual average, are reflected in the following table and graph:

The novelties and the most striking records of Cuba’s imports in 2022 and during the six-year period, include the following:

- The ostensible increase (62%) in imports from Venezuela. Purchases from the South American nation represented 20% of Cuba’s total imports and almost doubled purchases from China and Spain, respectively.

- The relative stability of China and Spain as suppliers of goods with an average value of slightly more than 1 billion dollars, despite the persistence and worsening of adverse conditions in the Cuban economy and internationally.

- The reaffirmation of Russia in fourth place among export partners to Cuba.

- The rise of the United States to ninth place, according to the six-year average. In this regard, it should be noted that, although it is a subject that currently causes frequent headlines, at least until 2022 the value of the exchange with the United States does not exceed 3% of the total Cuban exchange. In addition, said exchange is made up almost exclusively of imports.

- The inclusion of the Netherlands among the top ten exporters (displacing Germany), showing sustained growth in its sales to Cuba during the six-year period.

- The exports of these ten countries, as a whole, represented 74% of Cuba’s total imports in 2022.

- Cuba’s imports during 2022 registered a growth of 17% compared to the previous year. However, it should be borne in mind that their value (9.833 billion dollars) represents only 67% of what was imported in 2013 (14.707 billion dollars), the year with the highest historical record in the ONEI report.

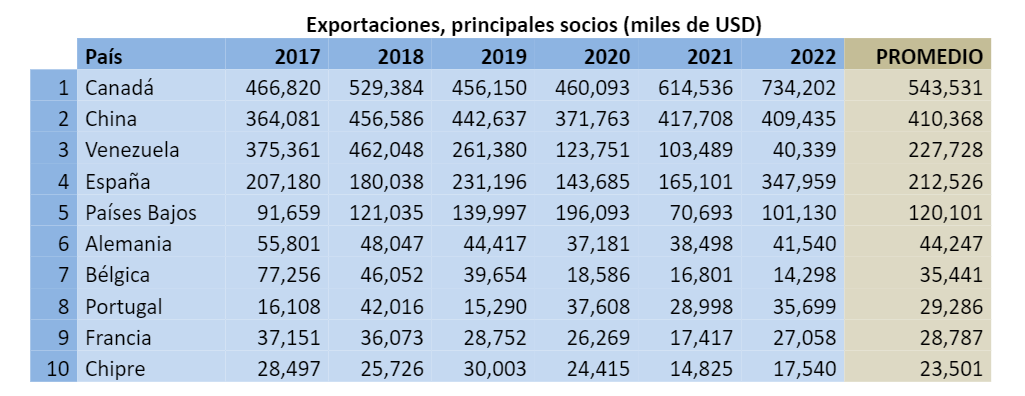

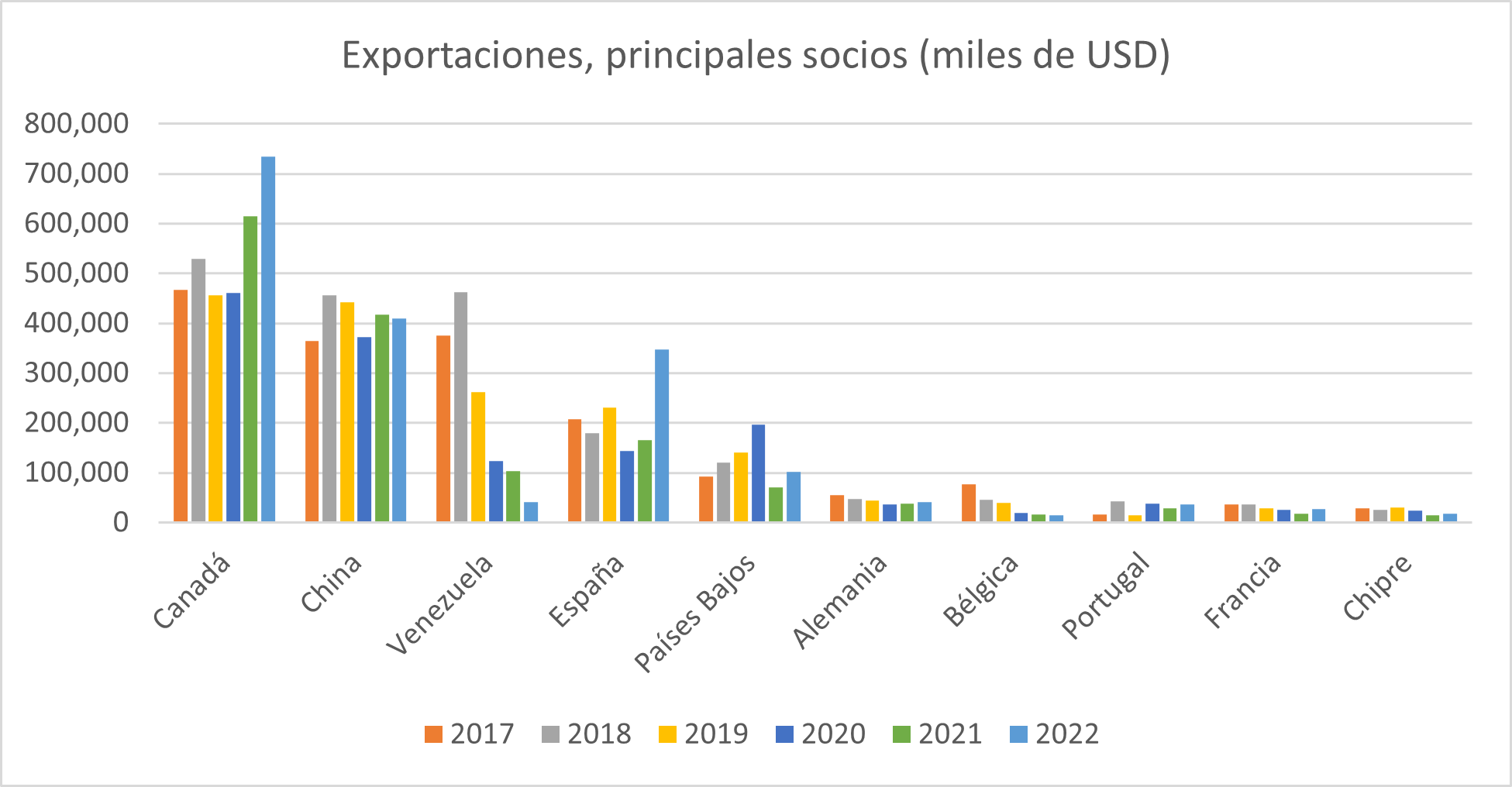

On the export side, Cuba’s ten main trading partners, according to the six-year annual average, are shown below:

Among the most notable aspects of the behavior of Cuban exports in 2022 and throughout the six-year period, the following can be pointed out:

- The significant growth (19%) of exports to Canada in 2022, which were widely higher than the six-year average and represented just over a third of total Cuban sales to other countries.

- The stability of China, which has established itself as the second most important destination for Cuban exports.

- The downward trend of sales to Venezuela (a 61% decrease in 2022, thus completing four consecutive years of decline), although for the moment it remains the only Latin American and Caribbean nation included among the top ten importers.

- The marked growth of sales to Spain in 2022 (111%), which exceeded 300 million dollars for the first time in the six-year period.

- Only five countries import more than 100 million dollars from Cuba and their respective markets, as a whole, account for 75% of their total exports. Cuban exports have a degree of concentration, in terms of destination countries, appreciably higher than imports, in terms of countries of origin.

- In addition, in 2022 the first five countries that purchased Cuban goods maintained their respective positions with respect to the previous year.

- In 2022, Cyprus entered the list of the ten main destinations for Cuban exports, according to the six-year average, displacing Singapore, although in both cases national sales register relatively small amounts.

- Cuba’s exports in 2022 registered a growth of 10% compared to the previous year. However, it must be borne in mind that their value (2.17 billion dollars) represents barely 36% of what was exported in 1985 (6.002 billion dollars), the year with the highest historical record in the ONEI report.

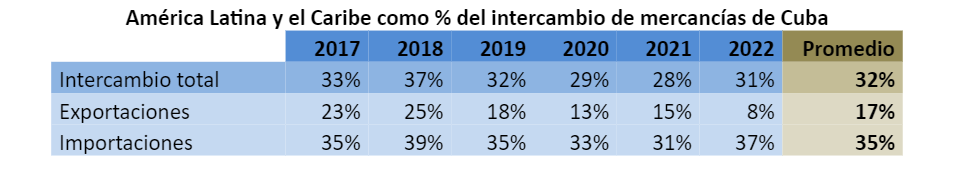

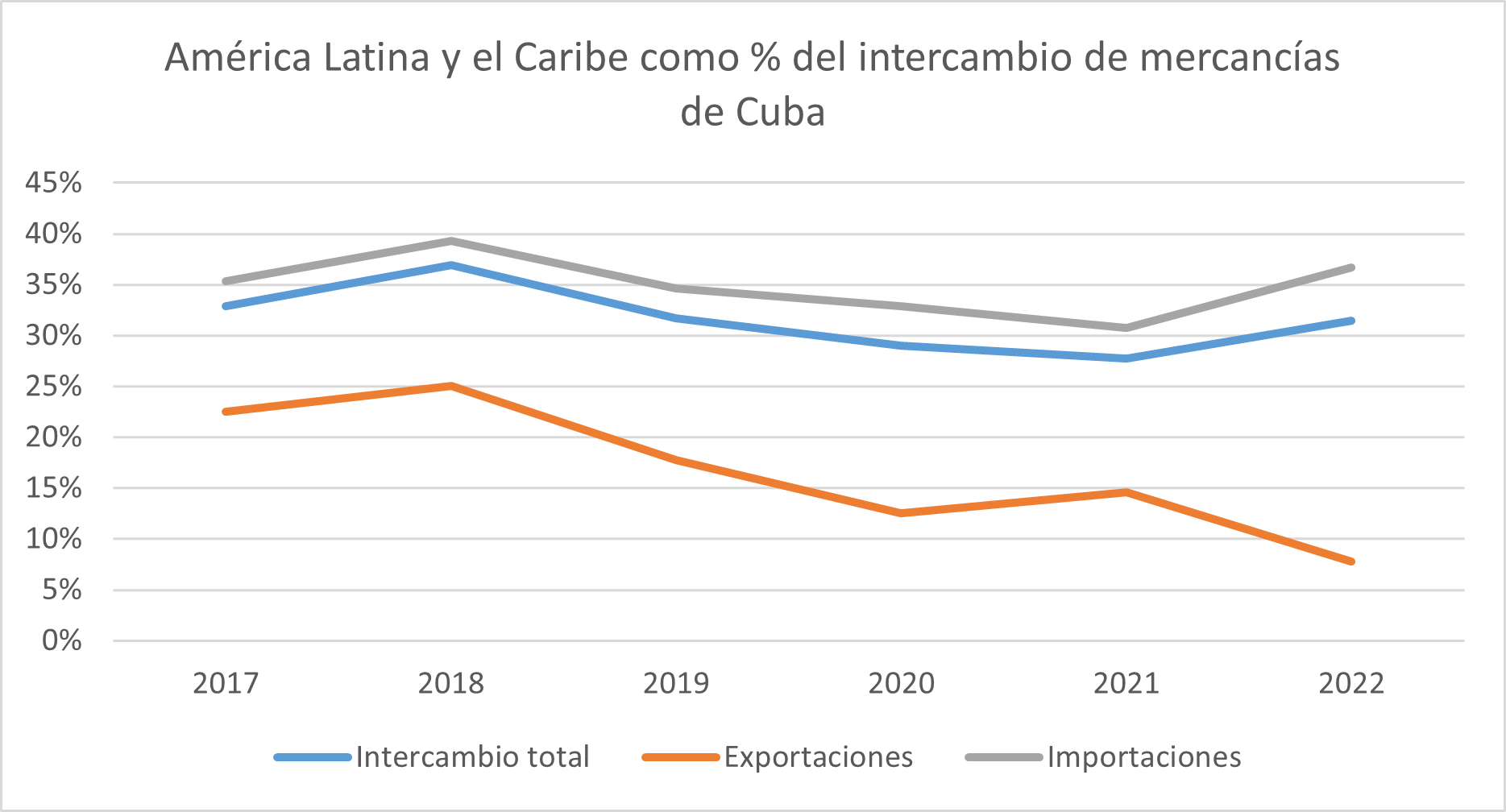

The countries of Latin America and the Caribbean maintained a participation of around 30% of Cuba’s total trade in goods, although increasing on the import side (6%) and decreasing (-7%) on the export side.

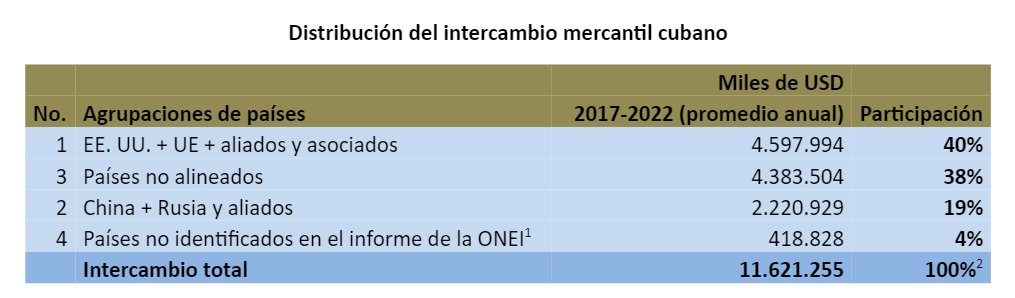

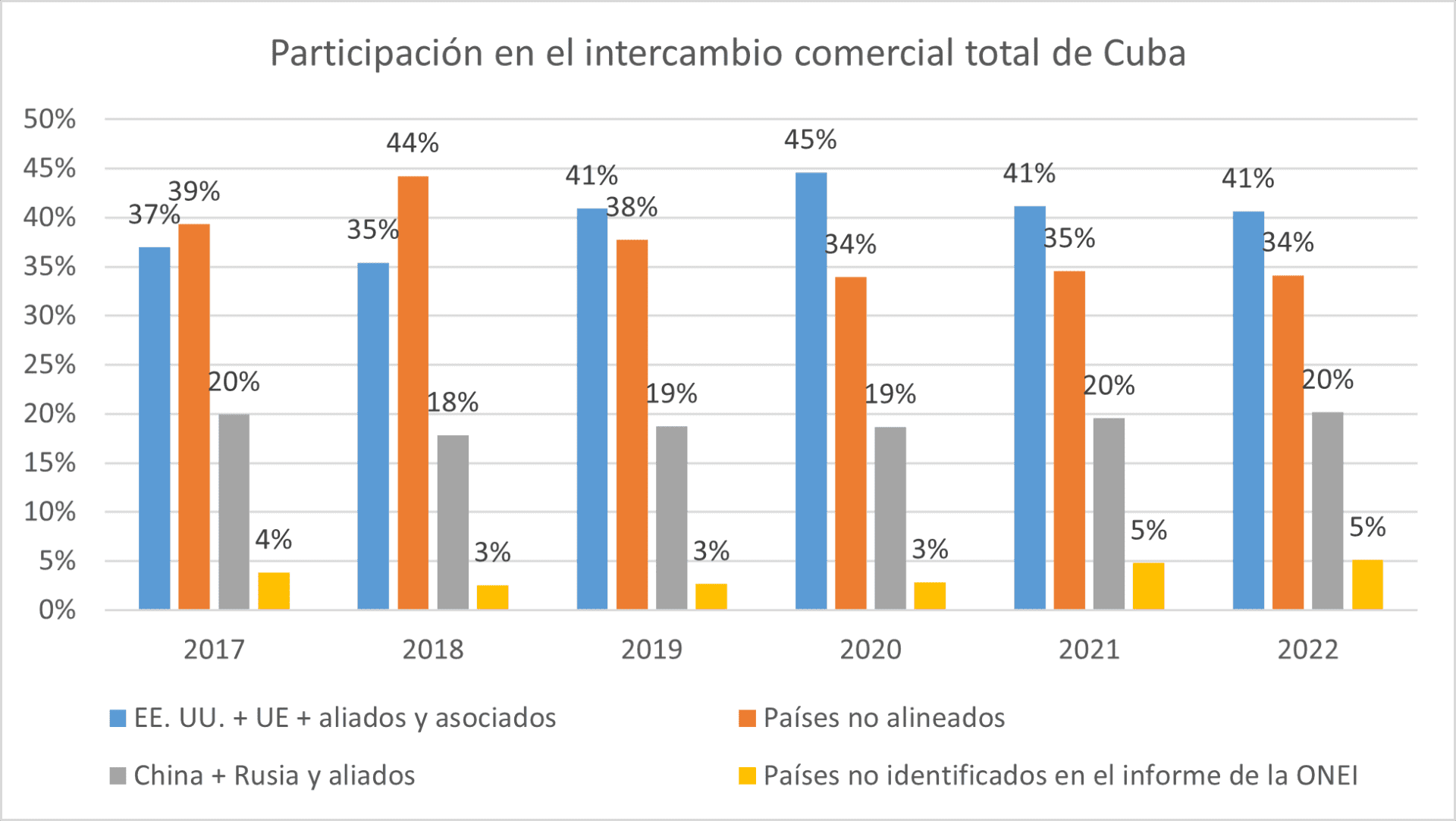

In the previous article I proposed a classification into three groups of the 193 Member States of the United Nations, based on their respective basic positions within contemporary international politics. Based on this classification and the new data for 2022, the distribution of Cuba’s trade in goods, considering the annual average of the six-year period, is shown in the following table.

The annual behavior of the participation of each group in the total exchange can be seen in the following graph:

The distribution of 2022 is very similar to that of the previous year. Among the trends of the six-year period, the most interesting element is the very significant participation of the countries that make up the bloc led by the United States in Cuba’s foreign trade.

Some “geopolitical” readings of Cuba’s trade in goods

The elements presented above allow us to reach the following conclusions:

In the first place, the data for 2022 ratify the strategic importance for Cuba of the commercial relationship with Canada, already highlighted in the analysis of commercial transactions of the previous year. In addition to being the main destination for national exports, it is the only partner with which Cuba registers a significant trade surplus, which in 2022 reached 523 million dollars. Curiously, it is a close political ally of the United States, a member of NATO and a supporter of the OAS. A perfect example, surely on a much smaller scale, of how economic relations between the United States and Cuba could be, if the imperial will did not mediate.

Last year Cuba significantly increased its imports from two traditional political partners: Venezuela and Russia. Paradoxically, these are countries that during the last three years have imported fewer and fewer Cuban products.

In the case of Venezuela, although the ostensible recovery of imports from that country constitutes a very positive fact from the specific point of view of the bilateral relationship, at the same time it reinforces a relationship of dependency of the Cuban economy, placing it in a situation of high vulnerability in a broader strategic sense.

On the other hand, in the case of Russia, the evident increase in bilateral trade does not, however, provide sufficient elements — at least for the moment — for those who insist on the notion of a “Russification” of the Cuban economy. Russia is — and probably will continue to be for a long time — a very important economic partner for Cuba, but only one among many.

Lastly, during 2022 Cuba maintained a healthy distribution of its exchange in goods among the main blocs of contemporary international politics. However, the trend towards concentration of trade in very few partners is particularly worrying, especially in the case of exports.

________________________________________

Notes:

1 The fact that the ONEI information reports a certain volume of Cuba’s trade with “other” countries, without specifying them, poses a difficulty from the analytical point of view and determines that we must take this percentage distribution by groups with some reserve from the statistical point of view. If, for example, we assume that this 4% of trade with unidentified countries corresponds entirely to non-aligned countries (an unlikely situation, although not impossible), then that group would become the majority in trade with Cuba by a narrow margin, adding 42%, compared to 40% accumulated by the group of countries led by the United States.

2 The respective shares of the groups do not always add up to exactly 100%, due to rounding of numbers.

________________________________________

- Read the first part of this article.