At the end of February, the preparation of the first Ranking of Notoriety of private sector brands in Havana made headlines. The event, unprecedented in the Cuban context, generated not a few reactions and expectations, both in the community of entrepreneurs and in the general public.

An initiative of SMG Branding, a private company dedicated to strategic branding, the ranking was based on the criteria of Havana consumers and focused on three lines of work in particular: fashion, cosmetics and catering, a category that includes restaurants, cafeterias, bars, bakeries, among other businesses along this line.

For its creation, the PieDerecho research team surveyed — both digitally and face-to-face — a representative sample of Havana residents. The study carried out in January, covered 385 people based on quotas proportional to the Havana population, both by sex and by age groups.

This figure, although it may seem small for the Cuban capital, was calculated based on scientific criteria and statistical formulas, and its results have a confidence level of 95%, as explained by the researchers.

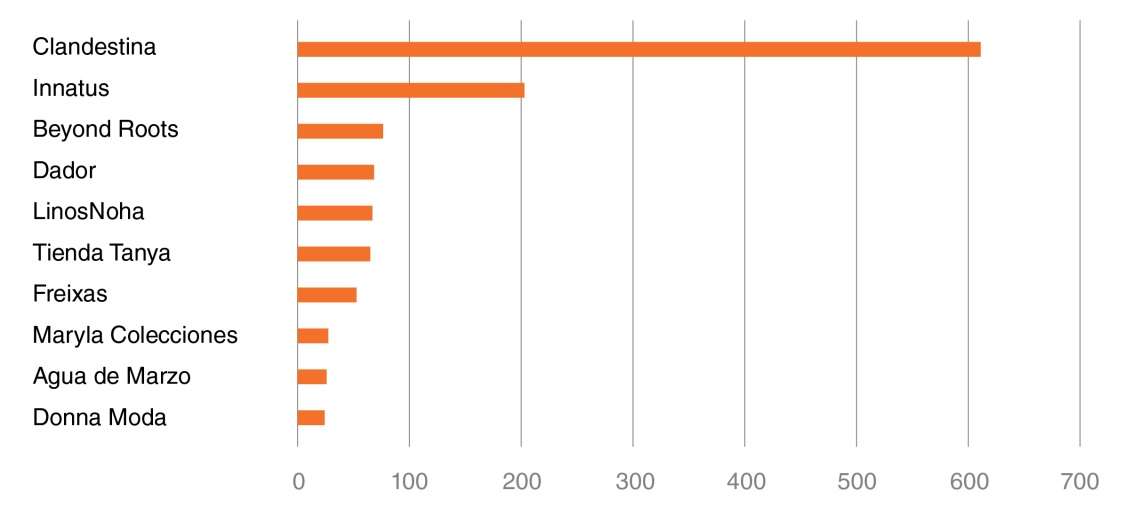

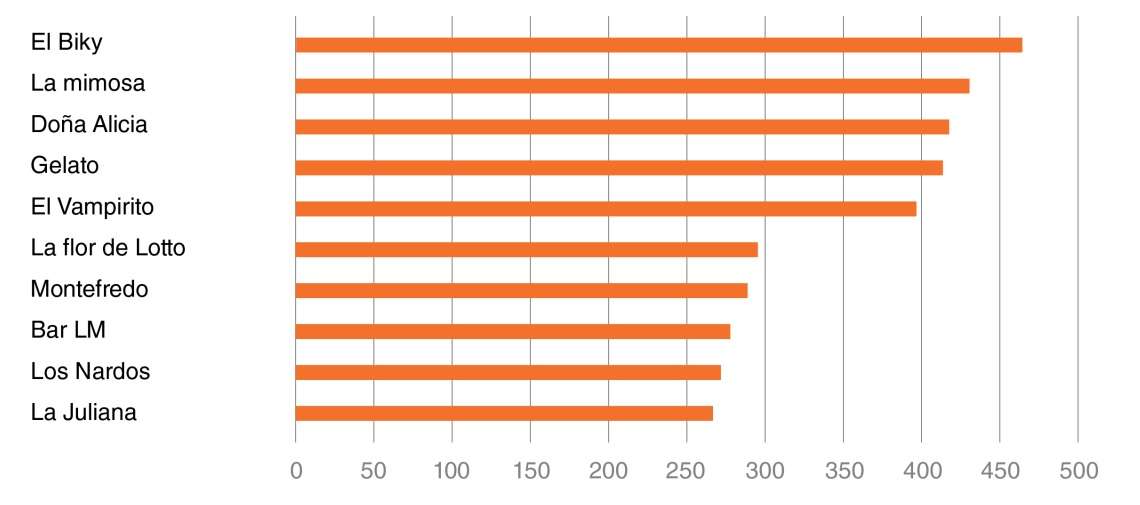

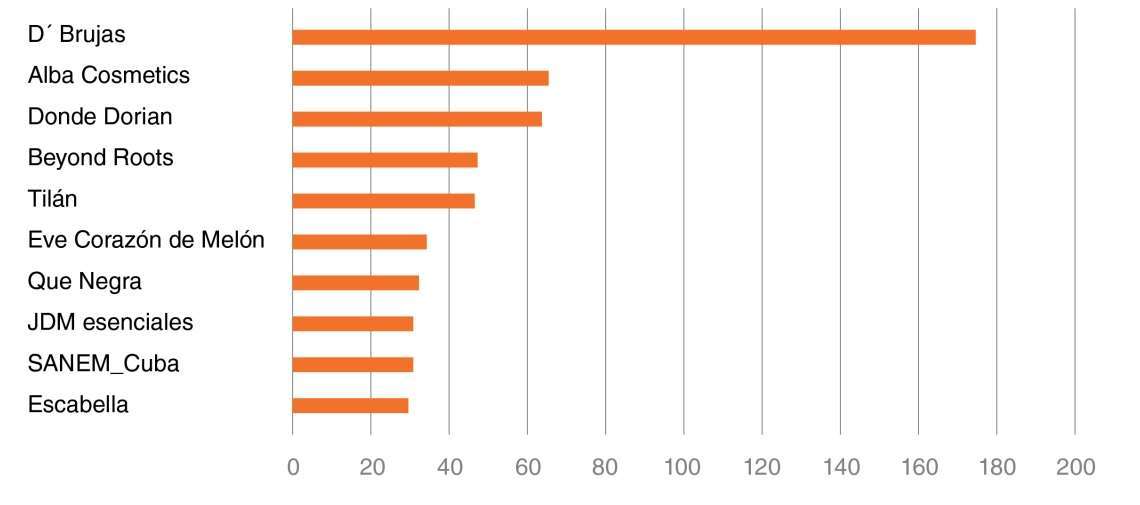

The results obtained in the surveys were organized hierarchically to establish the ten leading ventures in each sector evaluated. To do this, the researchers awarded points to the mentioned brands following the place in which they were referred to by each respondent.

As we reported then, Clandestina, in fashion; D’Brujas, in cosmetics; and El Biky, under catering, were the most notorious brands — the so-called top of mind — by category. In addition, the first two achieved a wide difference with respect to their main competitors. At the same time, the gastronomic sector confirmed high competition, according to a publication by the organizers of the ranking.

However, other private brands also demonstrated a good position in the minds of Havana consumers. Among them we can mention La Mimosa, Doña Alicia, Gelato and El Vampirito, under catering; Innatus and Dador, in fashion; Alba Cosmetics and Donde Dorian, in cosmetics; and Beyond Roots, which had the particularity of being among the first both in this last category and in fashion.

Although some time has passed since the presentation made at the Royalton Habana Paseo del Prado Hotel, the ranking of well-known brands continues to raise questions, both about its composition and the data that emerge from the study carried out, as well as about its meaning and relevance for the island’s growing private sector.

About these issues and the perspectives being opened based on the preparation of these first three lists, OnCuba spoke with Suselmis Martín Guilarte, executive director of SMG Branding.

How did you come up with the idea of creating the ranking?

SMG has been working on brand management for four years now, and after the pandemic, we have seen very strong work in certain sectors, such as cosmetics, with brands that did not exist before COVID-19. We, who are monitoring this entire scenario due to our professional profile, reached a point last year where we said it would be important to start 2023 with something that encourages brands. And it seemed to us that this encouragement had to come from consumers.

In addition, we also did not have a better evaluation method within our reach. At some point, we aspire to be able to make a brand valuation model, but in the Cuban context the conditions to get there are still not given. However, surveying people and knowing the brands that the Havana consumer has in mind, that we could do. And that was what we did: determine what those brands are and put them in a ranking.

So what we did was a first step, and that first step is notoriety.

What is meant by notoriety?

It is essential to clarify that the notoriety we are talking about is not directly associated with business success. It is the ability of the consumer to identify or recognize a brand in a given sector. And that was the path we took in this first evaluation.

What we were looking for, as I explained to you, was to know which brands the Havana consumer recognized when faced with a single question: “What brands of Cuban non-state businesses from each of the selected sectors come to mind?”

To do this, we asked those surveyed to answer in order of priority, which allowed us to determine not only the best-known brands but also the highest level of notoriety, the top of mind, which is the first brand that the consumer mentions when asked and which is the most notorious from their point of view.

Why did you select these three sectors for this first ranking?

We decided that at first there would be three sectors because of time, so as not to extend more than we intended in the application of the surveys and the processing of the data, and also because of financing, because a study like this needs resources.

When it came to choosing the sectors, we debated a lot, because we know that there are sectors, for example, computer science, that have long-known brands. But, at the same time, this is a sector that works a lot with state enterprises or abroad, and we wanted brands that were for mass consumption, brands that the Havana population, in general, could have access to.

That is why we decided on fashion and cosmetics, which we saw had had a rise during the pandemic here. And also catering, that is, restaurants and other gastronomic establishments, because it is one of the oldest lines of non-state work in Cuba, one of the pioneers when the private sector took off in the country, and, in addition, it has a recognized tradition and acceptance by consumers. So we bet on these three sectors, and we did it now because we believe that the work of their brands needed to be made visible.

Beyond the novelty, what relevance does a ranking like this have for startups and their brands in the private sector?

Brands often invest a lot of time and money in advertising, communication, in the experience of their brands. All this has a cost, from the design of a point of sale, the brochures, the advertisements to the management of social media, and it could be that entrepreneurs, their employees, even the consumers themselves, may wonder what all this is for if all that communicative work really works or doesn’t work, if that money is being invested well or is it really being lost.

The ranking of well-known brands allows us to answer that. It makes it possible to say to those brands: look, you’re in the minds of consumers. Everything you have done to achieve it, all the cost, not only monetary but also human, of time, the effort invested, has been worth it. And I think that’s why, when we presented the ranking, you could see the emotion of the leaders of the brands included in it, of those that were in the top positions, because it is a recognition of the consumers for their work, for the years they have dedicated to it. Seeing yourself in the ranking was like making that work tangible.

The ranking allowed us to make something as intangible as a brand tangible, and demonstrate that after so much time and effort, it is possible to be in the minds of consumers. That’s where the real competition is, not on a store shelf or in stock. It is in the whole process, from the moment consumers start thinking about buying a product or a service, those brands they are going to list, in which they are going to think to satisfy that need or that desire. That is the real competition.

In addition to knowing the most well-known brands, what other readings have you been able to make of the study carried out for the elaboration of the ranking?

The work we did to prepare the ranking has allowed us to know, in addition to the most well-known brands, that there are many opportunities in the market. Because up to this point everything was as if by intuition, empirically, but now, based on the study carried out by the PieDerecho team, we were able to do other analyses, other readings, which show us that when you test the market, it always surprises you.

Moreover, very interesting data emerged that can later help decision-making by the ventures themselves. In other words, with the data revealed by this study, much more intentional work can be done with consumers, with the potential public, and this is something that the brands themselves are grateful for, because they are analyses that can positively influence their work.

Can you comment on some of those results that emerged from the study?

For example, we confirmed something that could be supposed intuitively, but that we have already proven through surveys, and that is that in the fashion and cosmetics sectors, women are the ones who have the greatest knowledge of brands, because they are, in addition, the ones that consume the most.

Another fact that we confirmed is that in the municipalities where the brands are located, that is, where the physical headquarters of the businesses are located — although there are some that do not have them and only market their products in the digital environment — the public’s knowledge of the brand is much higher than in other municipalities. This shows the influence of brands in their environment and the interaction of the public with their space.

However, in the restaurant sector this is not always the case, and the degree of dispersion of its consumers, according to the results of the surveys, is much greater. We found people who mentioned restaurants or cafeterias from other municipalities instead of one from their own municipality. This sector, moreover, was the one that had the most brands or establishments named by consumers, with around 60, and it was also the most competitive because the difference between the brands that occupied the first places was only a few points and there were others that came behind.

On the contrary, in those of fashion and cosmetics, the brands were repeated much more and the total number of brands listed was smaller. And the difference between those that occupied the first and second place, between the latter and the third, and so on among the others, was greater. In other words, the brands that were the leaders in these sectors demonstrated a high degree of awareness among consumers. They were brands that were repeated very regularly when the surveyed people were asked.

And in terms of data that may be useful to the brands themselves?

Well, we have received a series of data about consumers, which has to do with their knowledge of brands, related to age groups, with the places where they live, which can be very useful for the brands themselves to make decisions.

For example, the study revealed that 70% of Havana consumers are unaware of brands in the fashion sector, especially among men. Well, there is a market opportunity there, there are decisions that can be made by the brands in order to achieve a greater reach.

The age range validates that the ages between 20 and 34 are the ones with the greatest mastery of the variety of brands. This is something that we had already been seeing, although in some studies, depending on the sector, this knowledge can reach up to 40-something. Now, of all the sectors, it was that group of 20 to 34 years that showed the greatest knowledge. It was able to recognize brands, to identify brands in the three sectors studied with total normality, while the one over 65 years of age is the one who least knows the subject of private sector brands in Havana.

In general, the ranking, only with what we did now, allowed us a reading about the behavior of Havana consumers, with very interesting data, which we can internally analyze based on our work.

A certain brand, for example, can ask us to know in which municipality it is more or less well-known, or in what age range, and then make decisions based on that. If it is a brand that wants to expand, you can already know where or in which age groups it is not so well known and you can direct your communication actions towards that public.

If you are very clear about the segment of the public you want to work with and that is validated by the market, then perfect, but if you want to expand and reach new segments, then based on the study we can tell you about those segments’ level of knowledge about the brand. And we can also do other types of triangulations based on the data we have and that can help brands work.

How do you assess the impact that the elaboration of the ranking has had?

The truth is that this surpassed us, we did not think it would have the repercussions it has had. In particular, we are very happy with the reception that the ranking has had among the private sector brands themselves. In the presentation event, we could feel the positive feedback, but we saw it since we were organizing it. Since we started issuing the invitations and we told the 30 nominees, ten per sector, we began to receive messages that astonished us, for the better, messages with very positive reactions, surprise and joy from those brands.

It has been very nice to hear the brands say that they were excited to know that they were in the ranking, that the public recognized them. Seeing the reactions of the representatives and leaders of those brands when they saw themselves on the screen during the presentation was very emotional, and so was listening to their argument, very true, that this is a very special recognition because the one who gives it is the public, the consumers for whom they work. And that is something very big.

Because we, as SMG, may have organized the ranking, but we did not decide each brand’s ranking, nor which entered the ranking. That was something that consumers themselves decided. And for us it is also very stimulating to see how private brands have been gaining space; when a brand, when its objectives are very clear, and when it works with quality and also works on the communication of its business, its products or services, even if its entry into the market is recent, it achieves recognition, a reach in society.

Even brands that didn’t make the ranking were enthusiastic and thanked us, for what it can represent as a boost to their work. And even brands from other sectors that we didn’t test now have written to us to ask us when we are going to study those sectors because this first edition created an expectation.

And what are the plans then? How do you plan to meet that expectation?

We want to make other editions of the ranking, and we want to test other sectors because now there were only those three that I mentioned. We would like to make a first notoriety ranking of these other sectors, perhaps in 2024, but this is hard and expensive work that we have to assess as we go along. And hopefully, at some point, we can come up with an evaluation model that allows us to know how much a brand costs, what its market value is, how the best global brands work, and how their changes also influence consumers.

But before running you have to walk, and every path, as the saying goes, always begins with the first step. And that’s what we did now, take the first step.