When the 1995 foreign investment law, Law 77, was passed, it was an innovation, the outcome of urgently needed adjustments to economic policy that arose following the Special Period. It sought to ease the profound crisis and to set out, using new terms, the foundations of the country’s development. But not that radically. While Law 77 makes it possible to invest in almost any sector and without any limits on capital contributions, its implementation has been at discretion and reserved.

“The policy of assimilation of investment and contracts has been far from stable over the last 20 years. While there was a boom of foreign investment in the 1990s, determined by the needs of the crisis of those years, this projection changed radically beginning in 2003.” (1)

Beginning in 2008, with the Economic and Social Policy Guidelines (known as the Lineamientos) probable changes to the legal framework were raised. The purpose was “to perfect regulations and procedures for evaluation, approval, and implementation of the participation of foreign investment, and simultaneously streamline the process.”

Likewise, this calls for “rigorous control over compliance with regulations, procedures, and commitments contracted by the foreign party when any form of foreign investment is constituted.” (2)

Today, any negotiations for foreign investment in Cuba must meet guarantee that certain objectives are met:

– access to advanced technology,

– access to management methods,

– diversification and expansion of export markets,

– substitution of imports,

– medium and long-term external financing to support the construction of the productive objective

– working capital contribution for its operation

– development of new sources of jobs. (3)

Within this context, the country and many would-be investors have been waiting for months for the announcement of a new regulatory legal framework. Many aspire for it to be the sign of an opening, and expectations are diverse. Will foreign investment be possible in the non-state sector? Could Cubans who reside abroad be considered as “foreign investors?” What new legal recourse will be presented to ensure national sovereignty over the country’s resources and the protection of its citizens?

Tourism: Is the recipient of the largest amount of foreign investment (more than 30%) and the second-largest source of income for the Cuban economy. In 2012, Cuba received 2,838,468 tourists. Main projects consist of increasing accommodations capacities and developing non-hotel infrastructure focused on diversification of the tourism product. The traditional options of sun/beach and events are joined by high-standard tourism, for which work is underway on hotels of 80-120 rooms, marinas, real estate companies, and golf courses in tourist destinations such as Trinidad, Ancón and Las Caletas (Sancti Spíritus); Santa Lucía (Camagüey); Ciego de Ávila; Covarrubias (Las Tunas); Guardalavaca (Holguín); and Cienfuegos.

Mining: Cuba is promoting the development of high value-added technical mineral production. This country has the largest proven reserves of nickel in the world (800 million tons) and it also has major reserves of marble and zeolite. Exploration is underway for gold, silver, copper-zinc, lead and chromium.

Oil: Cuba produces about 4 million tons annually. Currently, at-risk exploration is taking place with the participation of foreign companies in Cuba’s Exclusive Economic Zone in the Gulf of Mexico: 112,000 km2 and estimated reserves of 20 billion barrels. Cuba is promoting exploration in its EEZ, on the mainland and in shallow waters, as well as at-risk contracts for increasing production and recovery of operating wells.

Energy: Government will is combining with potential for the extensive use of renewable energy sources for producing electric power, especially solar energy, wind energy, and sugarcane biomass. Cuban law permits the country’s national electric utility, the UNE, to buy energy from independent producers.

Packaging: Essential for meeting the shortage of domestically-produced packaging that is affecting traditional and emerging manufacturing chains, whether by state production entities or private and cooperative ones. Cuba spends more than $400 million on importing plastic, glass, paper and cardboard packaging.

Steps for initiating a foreign investment process in Cuba

1. Identification of projects.

– Contact the Department of Commercial Promotion and Industrial Development of the Cuban Chamber of Commerce.

– Contract the services of a Cuban-based consultancy firm.

– Contact the corresponding government ministries and business groups.

2. Drawing up a letter of intent to do business or a framework agreement.

3. Preparing the required financial and legal documentation: Draft Business Partnership Agreement, Draft Statutes, and Economic Feasibility Study. Accreditation of the foreign party’s identity and solvency.

4. Presentation of the documentation to the Ministry of Foreign Investment and Economic Cooperation.

5. Approval (or denial) of the investment project.

6. Registration of the partnership in the Registry of Companies (Registro de Sociedades) of the Chamber of Commerce of the Republic of Cuba.

Notes:

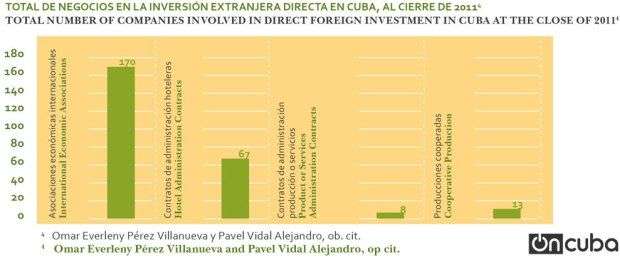

(1) Omar Everleny Pérez Villanueva and Pavel Vidal Alejandro: “La Inversión Extranjera Directa y la actualización del modelo económico cubano” (“Direct Foreign Investment and the updating of the Cuban economic model”).

(2) Economic and Social Policy Guidelines of the Party and the Revolution (Lineamientos de la Política Económica y Social del Partido y la Revolución). Document dated April 18, 2011.

(3) Idem.

(4) Omar Everleny Pérez Villanueva y Pavel Vidal Alejandro, op. cit.

(5)Idem.