We are in the last quarter of the year. It does not seem that we have had any news in recent months that would substantially change the performance of the Cuban economy for the better, at least for the remainder of the year.

It is not possible to deny that Lula’s presidency in Brazil, the possibility of the Morena party continuing in the presidency in Mexico, the consolidation of the MAS in Bolivia and the improvement of the Venezuelan economy are good news. It would be necessary to add the talks held with the representatives of the Paris Club.

Internalizing these favorable changes in the environment could help the effort to reform and recover the national economy.

However, we already have some certainties about what we still have left this year:

- The planned GDP growth will not be achieved.

- A substantial increase in supply will not be achieved.

- The projected number of tourists will not be reached.

- Inflation will not be contained to the extent that is needed.

- The allocation of investment resources will not have been modified to preferably orient it towards those sectors that could alleviate, at least in part, the shortage of essential products.

- We will continue to suffer from the electrical scare due to lack of generation, and fuel shortages.

- The state enterprise will still be far from achieving the dynamics that justify the fundamental role that it is recognized considering its weight in the GDP, and we will have to continue waiting on the wall of patience for a law — the law on enterprises — that contributes to its long-awaited autonomy.

- Foreign investment will remain limited by all those obstacles that were listed by the authorities of the Ministry of Foreign Trade and Foreign Investment almost two years ago.

- The debt renegotiation with suppliers will still be delayed.

- SMEs will continue to bear the burden of being the cause of inflation and will remain submerged in an ocean of legal and political uncertainties.

- For the remainder of the year, the drain of young and not so young Cubans abroad will continue.

- Bancarization will generate more concerns than solutions, more queues in front of ATMs where they exist and operate, and more time spent by the population in obtaining a service that is far from satisfying the need for it.

- We will not have a true exchange market and the capacity for effective intervention in it seems more unattainable than the horizon.

The paradox: the more done, the worse we are

If all this that is happening and will happen was the result of not having done anything in recent years, then everything would be easier to understand and, perhaps, it would also be easier to propose solutions. But it’s not like that.

Perhaps the incredible was done: national COVID-19 vaccines that saved tens of thousands of lives, including those of many who decided not to be here and protected them on their long and, at times, dangerous pilgrimage to other latitudes.

Other steps more directly associated with the economy were also taken, from adopting a negative list that expanded opportunities to found and develop businesses, to authorizing state enterprises to establish businesses with the non-state sector; accepting that this same sector could matter — always intermediated, of course, by a state “impo-expo”; we have also seen the increase in the number of these latter enterprises and the fact that today they can import practically any product; opening to SMEs, etc., etc.

An attempt has been made to recover key productive sectors — agriculture and sugar agribusiness — with extensive programs of measures. There was even an attempt to achieve the dream of having a single currency and a single exchange rate and remedy the monetary mess inherited since the 1990s.

It will be paradoxical, but perhaps in the years — these last three — in which more measures have been adopted to return the economic system to its dynamics, in which more openness has been achieved in the functioning of the economy if we compare it with previous periods, they have turned out to be those in which the worst results have been obtained.

It would be counterproductive if a mechanical interpretation of this paradox leads to the assumption that the reason, or one of the reasons, for this multicrisis lies in the “opening” of the economy.

It is true that we are fed up with diagnoses, that we have “stuffed ourselves” with endless lists of inexplicable and highly resilient obstacles, that we have suffered from that disease called “paralysis by analysis,” that in some sectors we have generated more measures than capacity and resources to execute them….

Prejudices, sectoral interests and political fear have taken us and brought us again and again to and from mediated proposals, where those prejudices have imposed themselves on the rationality of the proposals and have generated excessive inconsistencies, too much uncertainty.

The wounds left by this combination of factors — internal deformations and distortions, Trump’s measures, COVID-19 pandemic, failed Reorganization — are not superficial at all, some touch “vital organs” of our social body. Some of these organs will have to be replaced almost entirely.

State resizing

Getting our economy into shape is much more than increasing budgetary income at all costs, it is also drastically cutting expenses and to achieve this there is no other way than to resize the state apparatus and the state business system.

This experience is already known, since in the early 1990s something similar had to be done. Of course, it was under other internal and external conditions, so it is not possible to repeat the formula, but it is not convenient to discard it ex ante either.

This also forces us to further expand opportunities for everyone, because behind each percentage point of cut there will be a family that has to manage to accommodate itself within Cuba.

An oversized state apparatus in relation to the economic capacity of the system is not a strength at all, it is quite the opposite.

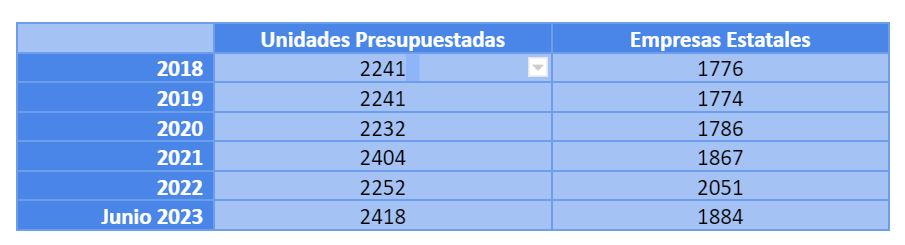

Under our current conditions, it is not possible to sustain more budgeted entities than state-owned enterprises in the productive sector and more employees in the budgeted sector than in the state-enterprise sector of the economy.

Source: ONEI, 2023.

In the same way, having countless state enterprises in all sectors, of all sizes and with results that leave much to be desired, umbilically tied to their respective ministries, has brought us to this situation that we face today.

Socialism is not defined by the number of state enterprises that exist. No “classical” text says it, but above all there is no evidence to prove it.

It is true, however, that if they are not state then they must be “non-state” in all the varied forms they may take.

It happens today that the ghost of SMEs is haunting Cuba and, thanks in large part to the media, has displaced the “Reorganization” as the main culprit of our current ills, especially high prices and consequently low purchasing power of the salaries as if before they were born we were no longer suffering from these evils. There we go with memory and history!

Longings

I remember in the early years of the 1990s when stores in U.S. dollars were opened, the tremendous rejection that they had among a part of the population. Then they became much more than a complement to the supply of goods and today almost everyone remembers them with nostalgia, just like the CUC.

Without making these structural changes in all their depth, a real, sustained victory in the fight against inflation will not be achieved. A macroeconomic stabilization program that half-heartedly addresses this problem, that postpones what needs to be done for fear of the present political cost, will only contribute to greater political costs in the immediate future.

For several decades now, we have chosen “graduality” as the way to lead changes. In the end, at least in the economy, we have not solved the essential problems and we have prolonged the cure so much that for many the wait became impossible, and they left the country.

It is true that shock cures are painful, but shock without a cure is deadly.