The Official Gazette No.28 published today new measures for financial and tax management in the field of Culture. The regulatory framework includes a decree-law and four resolutions of the Ministries of Culture , Labour and Social Security , and Finance and Prices (MFP by its Spanish acronym).

According to the report published this morning by Granma newspaper, Maritza Cabrera , Head of Tax Policy of the MFP , explained that these measures are created “in order not to increase the financial burden but sort current aspects and forms of remuneration; Social security schemes , and the payment of taxes in compliance with the principle that the contribution in correspondence with economic capacity.

“This will also remove the currently existing legislative dispersion, seeking greater uniformity of treatment on these matters, while help strengthen the bond and commitment of creators and artists with the state.”

From the coming into force of these new regulations and recently issued by the Ministry of Labour and Social Security on self-employement, they can hire labor for their works or preparing their submissions ; also have the possibility of access services provided by other creators , artists and self-employed . “Like in the rest of the non-state sector, the Tax by Using Workforce will be paid when using the services of more than five workers, which can be recognized as deductible expenses on Personal Income Tax” Maritza Cabrera says .

In the case of the income tax, the specialist clarifies, will not apply to wages paid to hired artists to entities belonging to the culture system, radio, television and other state institutions. “It will be taxed at the personal income tax on any additional income these workers obtain by marketing presentations and works, or the exercise of any other economic approved activity”.

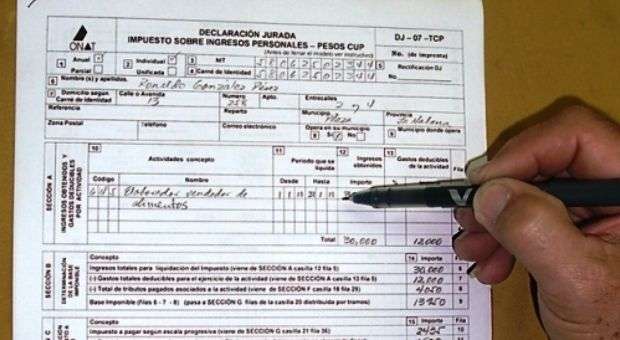

“From personal income they may deduct a minimum exemption of 10 thousand pesos and up to 50% of deductible expenses related to the activity, of which they only have to justify the 50%. Another peculiarity is that may be offset against taxes paid abroad provided they have the evidence established “the head of the tax policy department of the MFP explains.

As a new element it further provides that upon receiving a cash prize only have to pay 4% of the total amount at the Office of Tax Administration (Onat). In these cases the amount of money is excluded from the affidavit and shall not be considered taxable income within the Personal Income Tax.

In turn, in the regulations issued by the Ministry of Finance and Prices, states that the percentage share of firms for contract management and other services provided to artists and creators to market the works or presentations of art will be by mutual agreement and in a range of up to 30%. For discography it can reach 40%.

Regarding Social Security, Law Decree No.312 establishes a special Social Security regime for creators, artists, technicians and support staff who are not subjects of the general or other special social security regime. The scheme offers protection to members before old age, disability, maternity or in case of death to their family. Artists and creators will be able to choose the basis of contribution they need in the progressive scale designed for the payment of this tax, the specialist said.

As part of fiscal control to be carried out systematically and in order to update and strengthen the measures taken, there will be a massive re-registration of artists and creators in the Register of Taxpayers. Likewise, studies will be conducted on load and tax capacity of the different art forms, the specialist pointed out.