Since the late 1980s, foreign direct investment (FDI) has been included among the potential resources Cuba has had to boost growth and development. One would have to affirm that FDI did its job and that it did it well in spite of everything and that during all these years it has demonstrated how positive its results can be.

If we pay attention to the successive reports on foreign investments appearing in the Business Opportunities Portfolio that the Ministry of Foreign Trade has already been publishing for several years in each Havana International Trade Fair (FIHAV), it is possible to confirm what was previously stated.

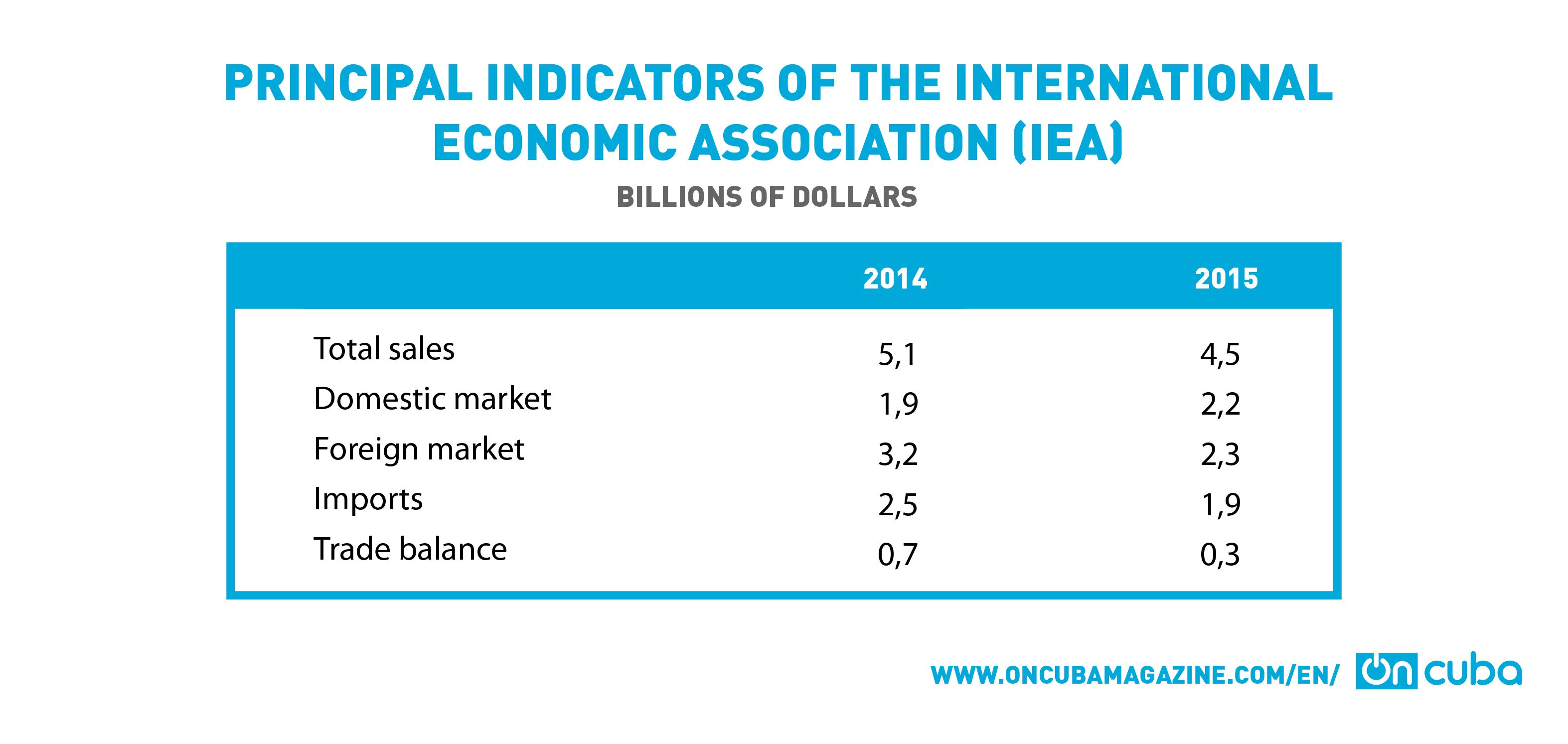

I call attention to the fact that the exports generated in the businesses with foreign direct investment represent an important amount in the total volume of Cuba’s exports of goods. For example, in 2014 total exports were 4.857 billion pesos (equivalent to US dollars) which is why the exports generated by the IEA represented 65.8{bb302c39ef77509544c7d3ea992cb94710211e0fa5985a4a3940706d9b0380de} of the total. In 2015, when the export of goods was reduced to 3.350 billion, the IEA’s participation in them went up to 68.6{bb302c39ef77509544c7d3ea992cb94710211e0fa5985a4a3940706d9b0380de}, which contributed to the country’s balance of goods.

It would be necessary to add other unquestionable positive effects, for example, in the case of power generation the Sherritt International joint venture that operates the combined cycle generation plant satisfies a high percentage of the energy consumed in the country’s capital, with positive effects for the environment since it uses a great deal of the accompanying gas from the zone’s oil wells, guarantees savings in hard currency for the purchase of oil and stability in power supply, in addition to the intangible benefits of allowing the training of its personnel and a steady employment for a group of Cubans.

Something similar could be said of Bucanero or Ciego Montero or Coralac, whose productions allow for supplying the national market of products in high demand, and replace imports with evident benefits for all, for the country’s accounts, for consumers and for those companies’ workers and their families.

Another still more significant example is tourism, the sector through which foreign direct investment started in Cuba practically 30 years ago. The transfer of knowhow for the management of this sector, the culture of quality, guaranteed issuing markets, Cuba’s image as a tourist destination, employment, fresh incomes in hard currency, opportunities of linkages for the national industry and Cuban agriculture, all these have been advantages that FDI has reported for the national tourist sector and if it has not reported more it hasn’t been precisely because of FDI limitations but rather our own limitations and prejudices.

I also call attention to the fact that in the late 1980s Cuba barely received around a quarter of a million international tourists, its hotels were very far from the quality standards demanded by that industry and Cuba was practically left out of the world tourist map. FDI’s contribution to drastically change that situation was decisive.

That is why, and because of the recognized needs Cuba has, I find it so difficult to understand how it is still possible today that there be so many prejudices against foreign investment and that we are unable to reach the investment flows needed by our country despite the fact that the government recognizes its importance.

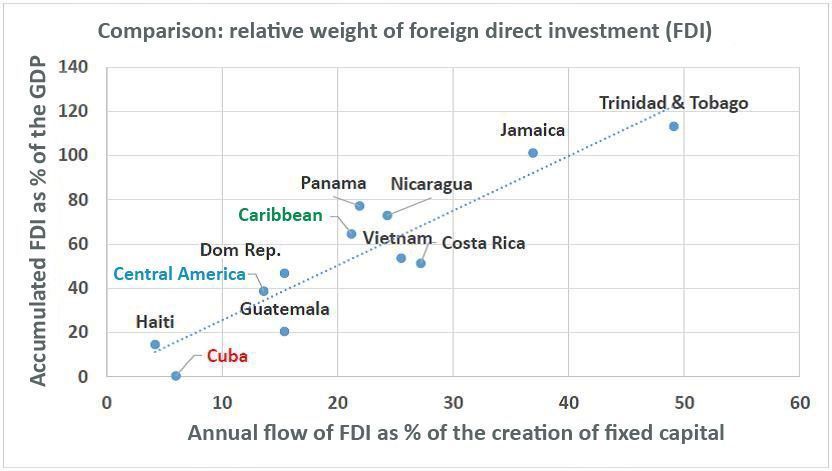

There is no doubt that Cuba still has immense opportunities to achieve a foreign investment flow that approaches our needs. Cuban economist Pedro Monreal published on his blog (https://elestadocomotal.com/2017/05/27/inversion-extranjera-a-cuanto-debemos-aspirar/) a comparison with our Latin American and Vietnamese counterparts that says much about what lies ahead for us.1

And it’s not that Cuba hasn’t made significant efforts in the promotion of FDI, sectorial fairs, trade missions, FIHAV. However, there is a notable asymmetry between the promotion of FDI the country has made and what is known as the “facilitation of investments.” The promotion consists in selling a place as a destination for investments, something that has been done once and again. Cuba also needs a significant effort in the facilitation of investments. The facilitation consists in taking measures to make it easier for investors to establish or expand their investments and carry out their day-to-day operations. Among them, it is feasible to point out some that today have already been identified as almost indispensable requirements:

• Improvements in the transparency and in the information available for investors.

• Measures to increase the efficiency and efficacy of the administrative procedures for investors.

• Improvement of the coherence and foreseeability of the regulatory environment for investors.

• Mechanisms for consultation, intermediation, and competitive, varied and efficient consultancy services.

• Establishment of supervision and assessment mechanisms for the facilitation of investments.

This 2017 is already, in economic terms, a tense and difficult year for the Cuban economy, and it doesn’t seem 2018 will be different. A combination of economic problems, some current and others dating back more years, together with absolutely unpredictable natural phenomena, like Hurricane Irma, have put and will put to the test the capacity to grow. Foreign investment can again be a resource that contributes to channeling the country along the path to sustained growth; it is true that it isn’t the only one needed, but it is an indispensable ingredient.

________________________________

Assuming that the goal of attracting annual flows of two billion dollars is met, for Cuba to be able to equal the average level that indicator has in Central America (38.8 {bb302c39ef77509544c7d3ea992cb94710211e0fa5985a4a3940706d9b0380de}), it needs approximately 17 consecutive years of two-billion-dollar FDI flows. (https://elestadocomotal.com/2017/05/27/inversion-extranjera-a-cuanto-debemos-aspirar/)